Have you ever splurged on a fancy dinner with “bonus money” but refused to spend a small extra fee for something more practical? Or maybe you treat gift money differently than hard-earned salary? By the end of this article, you’ll discover why people mentally label money in curious ways — and how businesses can use this knowledge to boost sales. Ready to explore your hidden spending habits? Let’s go!

In this section: We’ll define what mental accounting is, trace its roots, and see why understanding it can help both consumers and businesses. Then, we’ll discover the psychology behind this fascinating concept and learn its crucial role in modern marketing.

Definition and Conceptual Framework

Mental accounting refers to the way people categorize, evaluate, and keep track of their finances in mental “accounts.” Richard Thaler first introduced the idea around 1985. It highlights a paradox: money is technically fungible (all cash is the same), yet we still treat it differently based on where it comes from or how we plan to spend it. This is economically significant because it guides everything from daily budgeting to large purchasing decisions.

The Psychology Behind Mental Accounting

Several psychological biases fuel mental accounting. *Loss aversion* (from prospect theory) makes us more sensitive to losses than gains, so we often place tighter controls on certain accounts. Emotions also play a part: feeling guilty about using “fun money” for bills, for instance. For many, mental accounting also acts as a self-control technique—like setting aside “vacation savings” to ensure we don’t overspend elsewhere.

The Business Relevance of Mental Accounting

Why should brands care? Because if you know how customers categorize their spending, you can position your offers accordingly. You might present a product as a “reward” purchase or highlight how it fits a particular mental budget. This can confer a competitive edge. However, using biases responsibly is important—unethical manipulation can erode trust. The end result? Understanding mental accounting can influence everything from promotional strategies to product bundling.

You now know what mental accounting is and why it matters. Next, let’s dive deeper into the key components that make this process tick!

Core Components of Mental Accounting

In this section: We’ll look at how consumers create mental budgets, perceive value through transaction utility, and treat money differently depending on its source. Each of these factors shapes spending decisions in subtle but important ways.

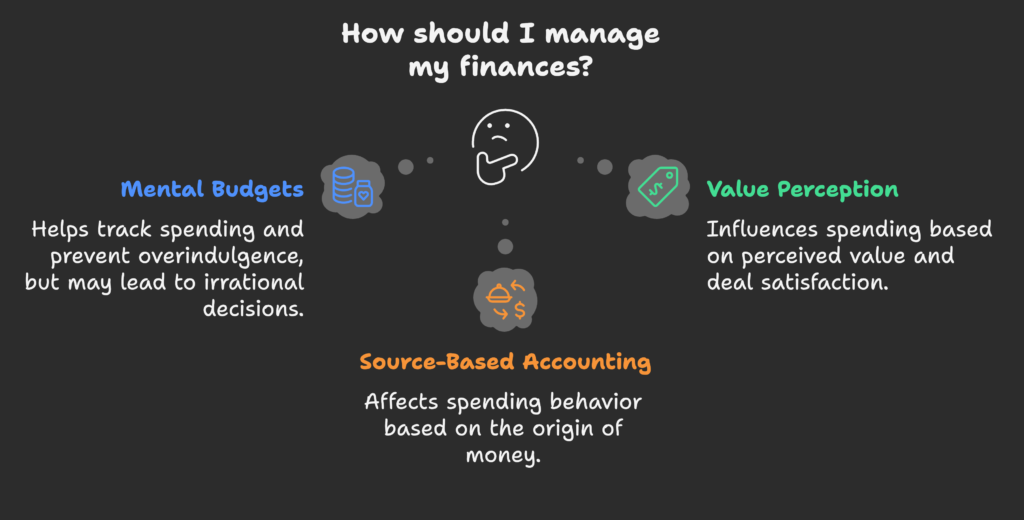

Mental Budgets and Categorization

People often compartmentalize expenses—groceries vs. entertainment vs. savings—like labeled jars. Some keep rigid boundaries, never mixing “car funds” with “dining out.” Others are more flexible. These categories help track spending and prevent overindulgence. But they can also cause irrational decisions, like taking a loan while having unused “vacation money” in another mental account.

Value Perception and Transaction Utility

Two angles shape how we judge a purchase:

- Acquisition Value: The product or service’s inherent usefulness to us.

- Transaction Value: How good a deal feels based on reference prices and perceived discounts.

Consumers love “getting a deal,” which often overrides rational calculations. *Pain of paying*—the unpleasant sensation when parting with money—also matters: if the process feels painful (like paying cash), people spend less. If it feels painless (like a contactless swipe), spending might rise.

Source-Based Mental Accounting

How people got their money can shape how they spend it. *Found money* (like a tax refund or gift) often goes to indulgences. *Earned money* or wages might be spent more carefully. The house money effect suggests that when we gain unexpected funds, we’re likelier to take risks or buy luxuries. We also handle future income differently than current income, sometimes ignoring tomorrow’s costs if we’re mentally focusing on today’s budget alone.

We’ve covered the main pillars of mental accounting. Next, let’s see how these concepts appear in everyday consumer life and major financial decisions!

How Consumers Engage in Mental Accounting

In this section: We’ll see how budgeting, risk assessment, and spending vs. saving patterns all reveal mental accounting at work. Recognizing these behaviors explains why seemingly “irrational” financial decisions can make perfect sense to the consumer.

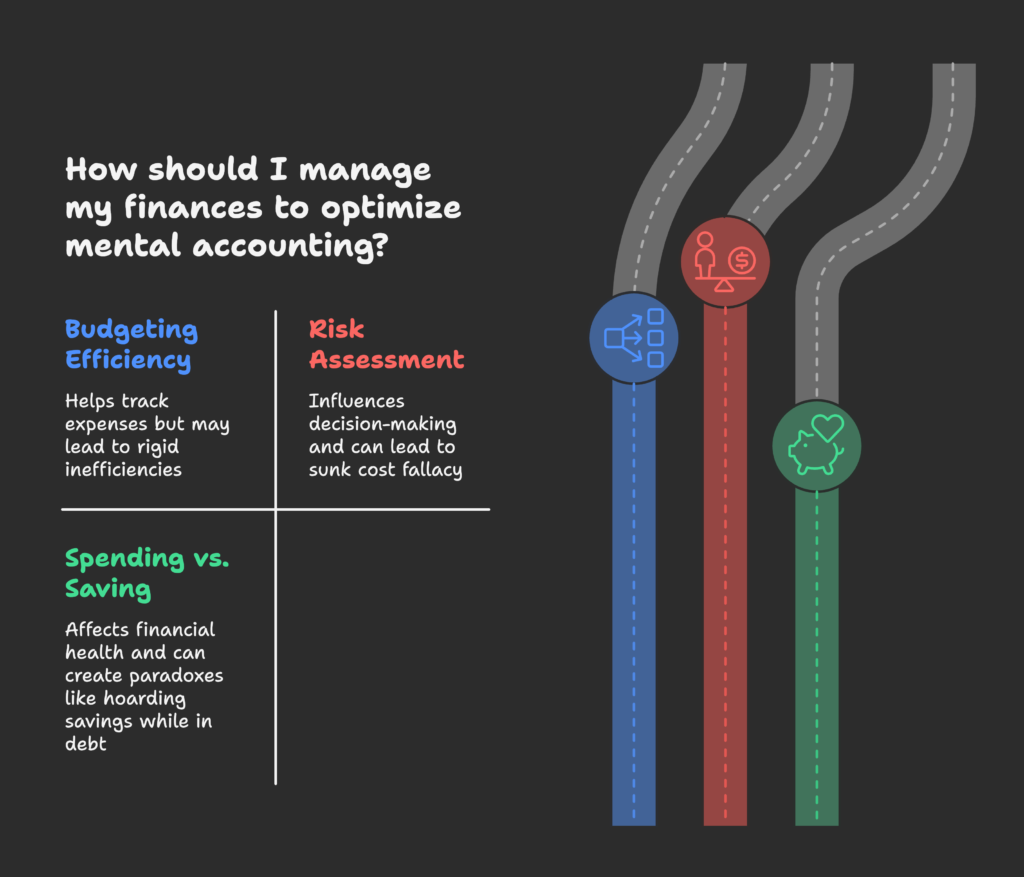

Budgeting and Financial Management

Many consumers track expenses by assigning categories—like “rent,” “groceries,” or “fun.” This mental separation can be helpful but can also lead to rigid inefficiencies (imagine going into debt on a credit card while letting a separate “vacation budget” sit untouched). While mental accounting fosters discipline, it can also hinder reallocation when needs change.

Risk Assessment and Decision Making

Mental accounting influences how we interpret risk. Sunk cost fallacy occurs when we continue investing in something because we’ve already spent money from a particular account, even if the decision no longer makes sense. Or we may handle small daily “risk” differently from big purchases, ignoring that money in both cases has the same ultimate value.

Spending and Saving Behaviors

Some mental accounts (like “bonus money”) might have a high consumption rate, while “emergency savings” remains untouchable. This mismatch can create paradoxes, like carrying expensive credit card debt while also hoarding savings in a separate account. Also, retirement planning can suffer if we mentally label those funds as “too far off,” leading to under-contributions.

Now you know how mental accounting works in day-to-day life. Ready for a broader look at different consumer contexts? Let’s move on!

Mental Accounting in Different Consumer Contexts

In this section: We’ll look at how mental accounting shapes everything from small grocery trips to major life decisions like buying a home. We’ll also explore how we mentally allocate money during special occasions or philanthropic acts.

Everyday Consumer Purchases

Going to the grocery store is a classic case: many people have a set “food budget” they hate exceeding. Meanwhile, entertainment might get its own pocket of funds. The concept of “treat yourself” emerges when we tap into a separate mental account labeled “splurge.” Payment methods also matter—cash feels more “real,” so we watch budgets more strictly than with credit cards.

Major Financial Decisions

Larger expenses like buying a home or paying for education involve multiple mental accounts. People might rationalize stretching their budget for something “essential” like a good school, but not for a similar cost in a discretionary category. Investments see the same logic: if it’s “retirement money,” we approach risk differently than if it’s “fun investing money.”

Special Circumstance Spending

Holidays or vacations often get special mental budgets. We spend more freely on gifts or once-in-a-lifetime trips, rationalizing it as separate from normal spending. Luxury items can be justified through “I deserve this” logic. Even charitable giving may come from a unique mental account dedicated to doing good, influencing how much we donate versus how much we spend on ourselves.

We’ve explored various scenarios of mental accounting at work. Next up, let’s see how businesses can apply these principles in pricing, marketing, and product design!

Business Applications of Mental Accounting Principles

In this section: We’ll see how smart pricing tactics, tailored marketing messages, and product design features can nudge consumers’ mental accounts. With ethical use, these strategies can improve customer satisfaction and brand loyalty.

Pricing Strategies Based on Mental Accounting

- Bundling vs. Unbundling: Combine multiple items into a single price to tap a single mental account, or separate them to justify each cost individually.

- Subscription Models: Present ongoing costs as small monthly fees, so it fits “regular bills” rather than large upfront hits.

- Timing Strategies: Some people prefer annual payments (one-and-done) vs. monthly (steady outflow). Cater to different mental budgeting styles.

- Decoy Pricing: Provide a slightly more expensive product next to your main item to make it look like a bargain by comparison.

Marketing Communications That Leverage Mental Accounting

Brands can frame costs as “less than your daily coffee,” linking a purchase to an existing mental category. Or highlight discounts to increase the “transaction utility.” Emotional appeals that show how a product fits a specific mental budget also work. Reducing the “pain of paying” by emphasizing intangible benefits—like time saved or happiness gained—often resonates.

Product and Service Design Considerations

Some features directly address mental accounting, like letting users set up separate “vaults” or “sub-accounts” for different goals. Flexible payment plans or installment options can reduce psychological resistance. Designers can also shape the user experience to highlight why costs are justified for each category or to combine costs in a single meaningful package.

We’ve covered how to optimize product and pricing. Next, let’s explore how mental accounting shapes loyalty programs and vice versa!

Loyalty Programs and Mental Accounting

In this section: We’ll dive into how loyalty points act as separate currencies in consumers’ minds, how strategic program design can encourage redemption, and why mental accounting fosters deeper brand ties.

Points and Alternative Currencies

Loyalty points often form a standalone mental account. Customers perceive these points as “bonus money” that can be spent more freely. The mismatch between point value and real money can lead people to accumulate or spend points in ways they wouldn’t with cash. Airlines and large retailers have leveraged this concept for decades.

Strategic Program Design

- Redemption Thresholds: Setting a certain points level for rewards can create a sense of urgency or challenge.

- Status Tiers: Tiered levels (silver, gold, platinum) reinforce mental categorization, motivating more spending for the next level.

- Expiration Policies: Deadlines trigger usage to avoid “losing out,” tapping into loss aversion.

- Cross-Program Partnerships: Letting points be spent in multiple ways merges mental accounts for more brand synergy.

Consumer-Brand Relationships Through Mental Accounting

People sometimes track brand-related spending in a unique mental account. Loyal fans might justify repeated purchases with “I get points,” or “I love this brand.” The deeper the emotional tie, the more likely they’ll keep building that brand-specific account—creating psychological ownership and forging a stronger brand-customer bond.

We’ve explored loyalty programs. Now let’s see how digital and financial tech innovations are shaping the future of mental accounting!

Digital and Financial Technology Innovations

In this section: We’ll learn how mobile payments, personal finance apps, and cutting-edge tech tools are changing how people track mental accounts. Businesses that adapt can stand out in a competitive marketplace.

Mobile Payment Systems and Mental Accounting

Apps like Apple Pay or Google Pay make spending feel almost frictionless, often reducing the pain of paying. Some digital wallets let you label funds for different goals, aligning with mental budgets. Automatic expense categorization can either reinforce mental categories or challenge them by revealing overspending patterns the user didn’t realize.

Personal Finance Applications

Budgeting apps like Mint or YNAB often adopt mental accounting language, letting users create “digital envelopes” for different expenses. Visual dashboards help highlight overspending. Many also offer “goal trackers” that harness mental accounts for saving (like a holiday fund or emergency stash) to keep motivation high.

Future Innovations in Mental Accounting Technology

We’re seeing AI-driven solutions that learn personal spending habits and give real-time suggestions. AR or VR platforms could show you updated budgets in a visual overlay as you shop. Even blockchain-based digital tokens might someday shape how people mentally categorize funds. The key is merging technology with psychological insights for a seamless, empowering experience.

Time to apply these ideas industry by industry. Let’s see how retail, finance, and subscription models benefit from mental accounting insights!

Industry-Specific Applications

In this section: We’ll explore real-world examples of how mental accounting shapes retail experiences, financial services offerings, and recurring subscription models.

Retail and E-commerce

Online stores can structure carts to highlight optional add-ons as “small extras” that slip into a separate mental category. Clear return policies can reduce the “pain of paying,” encouraging purchases. Post-purchase tactics, like sending a discount code for a related product, tap into a different mental budget for “future shopping.”

Financial Services

Banks can design checking and savings products that mirror mental accounts, letting customers easily separate funds. Credit cards offering tailored reward categories feed into mental budgets (like a travel card for “vacation funds”). Meanwhile, investment products might address how people view risky vs. safe money, guiding them to balanced portfolios.

Subscription and Recurring Services

- Pricing Structures: Monthly plans can feel more palatable than one large annual bill.

- Content Access Models: “All you can eat” vs. pay-per-use changes how people mentally account for usage.

- Bundling Strategies: Grouping multiple perks under one subscription reduces mental friction, as customers see a single outflow.

- Retention Tactics: Reminding subscribers of unused credits can tap into loss aversion, reinforcing their subscription.

Now that we see how industries leverage mental accounting, let’s discuss ways to measure these behaviors and refine strategies for maximum impact!

Measuring and Analyzing Mental Accounting Behaviors

In this section: We’ll explore different methodologies—surveys, experiments, big data analysis—to uncover how consumers organize their finances in mental accounts. We’ll also talk about the KPIs that track success in these interventions.

Research Methodologies

Surveys can ask people to group expenses or react to hypothetical scenarios, revealing mental categories. Lab experiments let researchers manipulate purchase conditions to see if participants shift spending accounts. Neuroimaging tools track brain activation when evaluating purchases. And frameworks from behavioral economics guide us in systematically testing mental accounting effects.

Data Analytics Applications

Marketers can analyze transaction histories to spot patterns—for instance, a spike in “fun purchases” after paydays (indicating a separate mental fund for treats). A/B testing different payment plan structures can also highlight how minor changes (like a monthly fee vs. yearly) shift consumer behavior. Over time, you can segment shoppers by their mental accounting style and tailor offers accordingly.

Key Performance Indicators for Mental Accounting Strategies

- Conversion Rates: Do mental accounting tweaks increase purchase likelihood?

- Customer Lifetime Value (CLV): Are we lengthening relationships by aligning with mental budgets?

- ROI on Initiatives: Compare marketing costs with revenue gains from mental accounting-based changes.

- Brand Sentiment: Do customers appreciate these tailored approaches, or feel manipulated?

Next, let’s ensure we handle mental accounting responsibly. We’ll look at ethical considerations and how to protect consumer well-being!

Ethical Considerations and Consumer Well-being

In this section: We’ll discuss the potential misuse of mental accounting insights, balancing them with consumer interests. We’ll also see how education, transparency, and corporate responsibility can ensure a win-win outcome.

Potential Manipulation Concerns

When do you cross the line from helpful design to exploitation? If you nudge people to spend in ways that disregard their genuine best interests, that’s unethical. For instance, forcing customers to keep large deposit balances might exploit mental accounts for “just in case” money. Government agencies sometimes step in if such practices harm vulnerable groups. Transparency is key—explain why you structure payment or product options the way you do.

Consumer Education and Empowerment

Helping customers see that money is fungible can lead to healthier financial decisions. Brands can offer tips on responsibly using their product or highlight potential pitfalls. Some companies incorporate financial literacy tools or disclaimers, turning mental accounting from a confusing quirk into an insightful budgeting method. Balanced usage fosters trust and loyalty.

Corporate Social Responsibility

Brands that value long-term customer relationships over short-term gains are more likely to adopt ethical mental accounting strategies. This might include offering flexible solutions if customers face sudden hardships, or providing clarity around hidden fees. Industry groups and regulators also encourage best practices, ensuring companies maintain trust while harnessing behavioral insights.

We’ve considered the ethics. Next, let’s see what the future holds for mental accounting—both in consumer behavior and technology!

Future Trends in Mental Accounting

In this section: We’ll predict how generational changes, global economics, and new tech might reshape mental accounting. We’ll also discuss where researchers are heading next in this fascinating field.

Evolving Consumer Behaviors

Young adults raised on digital finance might have different mental categories, perhaps grouping e-wallet funds separately from physical cash. Economic uncertainty can also cause people to create more “rainy day” accounts. As finances grow more complex, new mental categories may emerge (crypto, micro-investing, etc.).

Technological Developments

AI could offer real-time suggestions like, “You’re approaching your self-imposed entertainment limit.” Voice assistants might provide daily mental account summaries. Biometric feedback could even detect emotional spikes tied to spending, adjusting alerts or recommendations. As finances become an integrated ecosystem, mental accounts might merge or become more flexible.

Research Frontiers

Neuroscience continues to refine our understanding of how the brain handles mental accounts. Cross-disciplinary teams are exploring whether cultural differences shape mental budgeting. Long-term studies might track how mental accounting habits evolve over a lifetime—what starts as a strict “don’t touch my savings” approach at 25 might change drastically by 50. The goal: build better theories that reflect real human complexity.

Finally, let’s wrap everything up with a concrete roadmap for businesses to put these ideas into practice!

Implementation Guide for Businesses

In this section: We’ll offer a step-by-step path for companies wanting to incorporate mental accounting principles into their strategies. From initial auditing to scaling successful initiatives, here’s how to do it responsibly.

Assessment and Strategy Development

- Audit Customer Patterns: See how your target market naturally segments their spending (e.g., “need vs. want” accounts).

- Identify Opportunities: Match product offerings to specific mental accounts (luxury vs. necessity budgets).

- Plan Initiatives: Outline which tactics—bundled pricing, subscription structures, loyalty programs—fit your brand’s goals.

- Allocate Resources: Ensure you have the right tools and teams to execute mental accounting strategies well.

Testing and Optimization Framework

Start small with pilot programs—like offering a monthly plan in addition to an upfront cost. Track metrics to see if it boosts sales or satisfaction. Use A/B testing to refine, analyzing not just conversion but also user sentiment. Build continuous feedback loops to tweak your approach quickly when new data emerges.

Organizational Integration

Departments must coordinate: marketing, product development, finance, and support. Train teams on mental accounting fundamentals so they understand why certain decisions are made. Align these strategies with broader goals—like higher customer loyalty or better user experiences—to avoid short-term gimmicks that hurt long-term trust.

This completes our deep dive into mental accounting. Ready to see your customers (and sales) flourish under a more empathetic, psychologically attuned approach?

Quick Note: If you run a Shopify store and want to leverage these insights effectively, consider using Growth Suite. It offers tools to design flexible payment options, create targeted campaigns, and keep customers happily within their preferred mental budgets—while boosting your bottom line!

References

- Thaler, R. H. (1999). Mental Accounting Matters. Journal of Behavioral Decision Making, 12(3), 183-206.

- Thaler, R. H. (1985). Mental Accounting and Consumer Choice. Marketing Science, 4(3), 199-214.

- Thaler, R. H., & Shefrin, H. M. (1981). An economic theory of self-control. Journal of Political Economy, 89(2), 392-406.

- Norton, M. I., Mochon, D., & Ariely, D. (2011). The IKEA Effect: When Labor Leads to Love. Harvard Business Review.

- Prelec, D., & Loewenstein, G. (1998). The Red and the Black: Mental Accounting of Savings and Debt. Marketing Science, 17(1), 4-28.

- Heath, C., & Sol