Have you ever found yourself choosing a product with a “100% satisfaction guarantee” over a better alternative without such a promise? Or perhaps you’ve opted for the extended warranty on an electronic device, even though statistically you’d save money without it? Maybe you’ve abandoned an online shopping cart because there wasn’t a clear return policy?

If so, you’ve experienced zero-risk bias in action—a fascinating quirk of human psychology that profoundly impacts purchasing decisions every day.

Here’s the intriguing truth: humans have a natural tendency to prefer the complete elimination of a small risk over a larger reduction in overall risk. We’re hardwired to seek certainty, even when it’s not the most rational choice from a pure probability standpoint. And smart businesses are increasingly using guarantee strategies to address this bias and dramatically boost their conversion rates.

In this article, you’ll discover:

- Why customers abandon purchases due to perceived risks (and how guarantees can reverse this)

- The psychology behind zero-risk bias and why our brains crave certainty

- Four proven guarantee strategies that transform hesitant browsers into confident buyers

- How to design guarantees that create trust without exposing your business to excessive risk

- Real-world examples of brands that have increased conversions by 30-200% using strategic guarantees

- Step-by-step implementation guidance for your specific business type

Whether you’re running an e-commerce store struggling with cart abandonment, a service business trying to overcome the “intangibility gap,” or a B2B company facing long sales cycles, understanding and addressing zero-risk bias could be the key to unlocking significant growth. Let’s dive in!

Understanding Zero-Risk Bias and Why It Matters

Before we can effectively counter zero-risk bias, we need to understand exactly what it is and why it has such a powerful influence on customer behavior. This foundation will help you see why guarantees aren’t just nice-to-have features but essential strategic tools for business growth.

What Is Zero-Risk Bias?

Zero-risk bias is a cognitive tendency where people prefer to completely eliminate a small risk rather than achieve a greater overall risk reduction. In simpler terms: we love certainty, even when it’s not the most logical choice.

For example, most people would prefer a guarantee of saving $85 over a 85% chance of saving $100 (which mathematically is worth $85), even though the expected value is identical. The complete elimination of risk creates a psychological comfort that partial risk reduction simply can’t match.

This bias appears across numerous decision contexts:

- Shopping decisions (especially for new or expensive products)

- Financial planning and investment choices

- Healthcare decisions

- Business strategy and risk management

For businesses, the implications are profound. When customers perceive any risk in a purchase—no matter how small—it can create hesitation, delay, or complete abandonment of the buying process.

The Power of Guarantees in Business

Guarantees have been used as business tools for centuries, but their strategic application has evolved significantly. The modern concept of risk-reversal guarantees gained prominence in the mid-20th century and has become increasingly sophisticated with digital commerce.

The statistical impact of well-designed guarantees is remarkable:

- Conversion rate increases of 30-150% are commonly reported after implementing strategic guarantees

- A/B tests consistently show that prominent guarantee messaging can reduce cart abandonment by 15-30%

- Customer lifetime value typically increases by 17-40% when strong guarantees build initial purchase confidence

These numbers reflect a fundamental psychological truth: guarantees don’t just address rational concerns—they provide emotional reassurance that taps into our deep-seated desire for certainty.

Why Businesses Need to Address Zero-Risk Bias

Understanding and addressing zero-risk bias creates multiple business advantages:

- Conversion optimization: Properly designed guarantees directly address the hesitation that prevents purchase completion

- Lower customer acquisition costs: When conversion rates increase, the cost to acquire each customer decreases proportionally

- Enhanced customer lifetime value: Customers who begin relationships with confidence tend to spend more over time

- Competitive differentiation: In crowded markets, strong guarantees can be a decisive factor in winning business

Perhaps most importantly, addressing zero-risk bias creates a virtuous cycle: customers who purchase with confidence typically have more realistic expectations, greater satisfaction, and higher loyalty—all of which contribute to sustainable growth.

Now that we understand what zero-risk bias is and why it matters to businesses, let’s dive deeper into the fascinating psychology behind this pervasive behavior. Understanding the psychological mechanisms at work will help us design more effective guarantees that truly resonate with customers’ deepest needs.

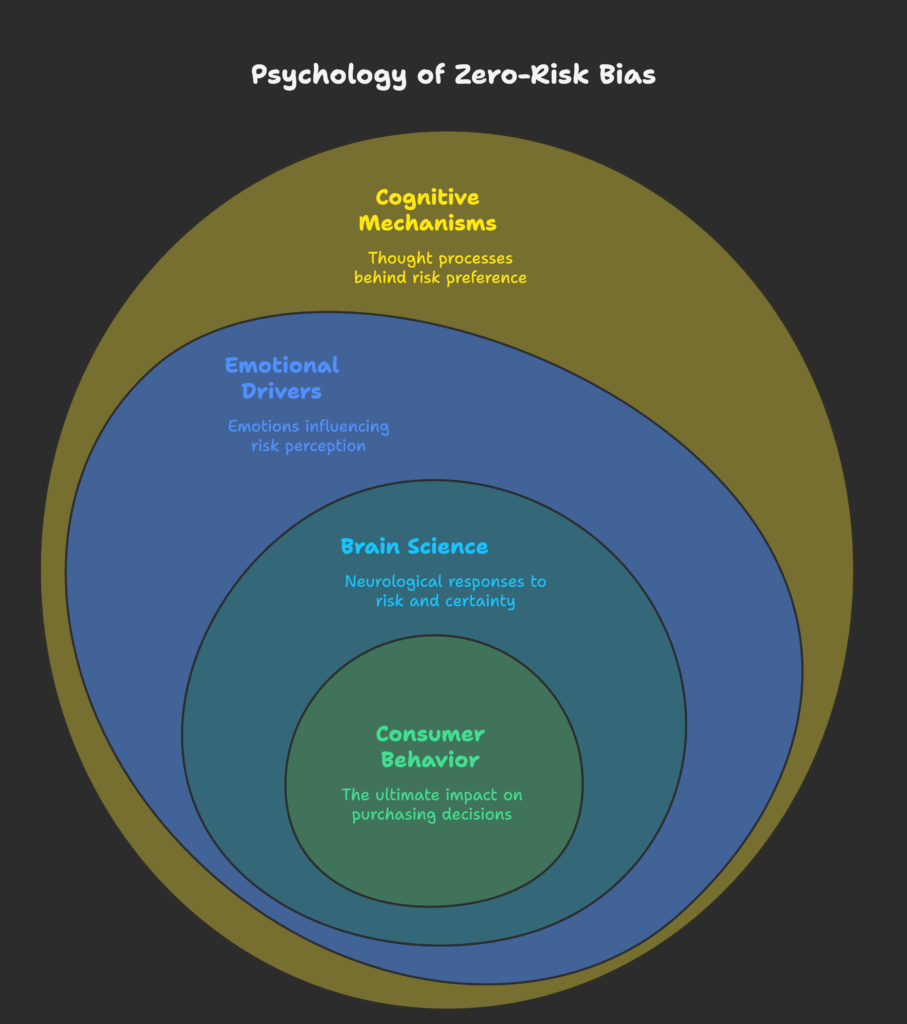

The Psychology Behind Zero-Risk Bias

To create truly effective guarantee strategies, we need to understand the psychological machinery operating beneath the surface of zero-risk bias. In this section, we’ll explore the cognitive, emotional, and neurological factors that make this bias so powerful—and how businesses can leverage this understanding.

Cognitive Mechanisms: How We Think About Risk

Several cognitive patterns explain why humans prefer certainty over probability:

- Mental shortcuts (heuristics): Our brains use simplifying rules to make quick decisions. The “certainty heuristic” leads us to overvalue guaranteed outcomes compared to probabilistic ones

- Uncertainty aversion: From an evolutionary perspective, uncertainty potentially signals danger. Our ancestors who approached uncertain situations cautiously were more likely to survive

- Cognitive load reduction: Evaluating probabilities requires mental effort. Complete elimination of risk simplifies decision-making and reduces cognitive strain

- Decision fatigue: As we make more decisions throughout the day, our capacity for careful risk assessment diminishes, making zero-risk options increasingly attractive

These mechanisms explain why even sophisticated customers who intellectually understand probability may still prefer guaranteed outcomes when making actual purchase decisions.

Emotional Drivers: What We Feel About Risk

Beyond cognitive processes, powerful emotions drive zero-risk bias:

- Fear reduction: Purchase decisions involve the fear of making a wrong choice. Guarantees directly address this fear

- Comfort in certainty: Humans experience a genuine psychological comfort from knowing outcomes are certain—a feeling that probabilistic outcomes simply can’t provide

- Anxiety management: The post-purchase period often involves “buyer’s anxiety.” Guarantees provide reassurance that helps manage this uncomfortable feeling

- Trust development: Guarantees signal that a business is confident in its offerings, fostering trust that transcends the specific guarantee terms

The emotional impact of guarantees explains why their effectiveness extends far beyond rational risk reduction. Even when guarantees are rarely used, their presence creates emotional comfort that significantly influences purchasing decisions.

The Brain Science of Risk and Certainty

Neuroscience reveals fascinating insights about how our brains process risk and certainty:

- Activation patterns: Brain imaging studies show that uncertain outcomes activate the amygdala (associated with fear and vigilance), while certainty activates reward centers like the nucleus accumbens

- Reward response: The brain’s reward system responds more positively to guaranteed outcomes than to probabilistic ones, even when the mathematical expected value is identical

- Stress reduction: Uncertainty creates measurable physiological stress responses. Guarantees reduce this stress by providing certainty

- Individual variation: Brain structure and neurochemistry differences explain why some customers are more risk-averse than others, suggesting the value of segmented guarantee approaches

These neurological findings help explain why even brief exposure to guarantee messaging can significantly impact purchase decisions—it literally changes how our brains process the purchase opportunity.

Now that we understand the psychological machinery driving zero-risk bias, let’s examine how it specifically affects consumer behavior across different purchase contexts. These behavioral patterns reveal the precise opportunities where guarantees can have the maximum impact on your business.

How Zero-Risk Bias Affects Consumer Behavior

Understanding how zero-risk bias manifests in actual buying behaviors gives us crucial insights for designing effective guarantees. In this section, we’ll explore the specific ways this bias influences purchasing decisions across different contexts and cultures.

Purchase Decision-Making in Action

Zero-risk bias affects the buying process in several key ways:

- Purchase delays: When risks are perceived, customers often delay decisions to gather more information or seek additional reassurance

- Price sensitivity adjustments: Research shows customers will pay 15-40% premiums for products with strong guarantees compared to identical products without them

- Preference patterns: Given similar options, customers consistently choose options with guarantee elements that eliminate specific risks, even when other options might offer better overall value

- Irrational risk assessment: Consumers often focus disproportionately on small, unlikely risks while ignoring larger, more probable ones—creating opportunities for targeted guarantee strategies

These behaviors explain why simply having an excellent product at a competitive price often isn’t enough to maximize conversions. Without addressing the zero-risk bias through strategic guarantees, businesses leave significant revenue on the table.

Different Products, Different Risk Perceptions

Zero-risk bias manifests differently across product categories and industries:

- E-commerce products: Without the ability to physically examine items, online shoppers experience heightened uncertainty about quality, fit, and functionality

- High-involvement purchases: Products with higher prices, complexity, or longer usage periods (like appliances or software) trigger stronger zero-risk bias effects

- Service industries: The intangible nature of services creates unique uncertainty that requires specialized guarantee approaches

- Ethical and sustainable products: Claims about ethical sourcing or environmental impact face distinctive trust challenges that targeted guarantees can address

Understanding these category-specific manifestations helps businesses design guarantees that address the particular uncertainties their customers experience rather than using generic approaches.

Cultural Factors in Risk Perception

Risk perception and the effectiveness of guarantees vary significantly across cultures:

- Risk tolerance variations: Research shows substantial differences in baseline risk tolerance across cultures. For example, consumers in uncertainty-avoiding cultures (like Japan and Germany) respond more strongly to guarantee strategies than those in uncertainty-tolerant cultures (like the United States)

- Social norm influence: In collectivist societies, guarantees that highlight social proof and consensus tend to be more effective than those emphasizing individual benefits

- Language and framing effects: How risk and certainty are communicated varies across languages, requiring careful adaptation of guarantee messaging

- Global marketing considerations: International businesses need specifically tailored guarantee strategies rather than simple translations of approaches that work in their home markets

These cultural variations explain why guarantee strategies that perform exceptionally in one market may underperform when applied without adaptation to other cultural contexts.

With this understanding of how zero-risk bias affects consumer behavior, we’re now ready to explore the specific guarantee strategies that effectively address this bias. These proven approaches can be adapted to your particular business model to significantly improve conversion rates and customer confidence.

Guarantee Strategies That Counter Zero-Risk Bias

Now we get to the actionable heart of addressing zero-risk bias: specific guarantee strategies that can transform hesitant browsers into confident buyers. This section explores four powerful approaches you can adapt to your business needs.

Money-Back Guarantees: The Classic Risk Reversal

The money-back guarantee remains the most versatile and widely applicable strategy for addressing zero-risk bias:

- Design principles: Effective money-back guarantees should be simple to understand, specific about what’s covered, and prominently displayed throughout the purchase journey

- Time-period psychology: The guarantee period has psychological significance beyond practical considerations. Research shows 30-day guarantees typically outperform 14-day versions, while 60+ day guarantees show diminishing returns for most products

- Conditional vs. unconditional: Unconditional guarantees (“no questions asked”) generally outperform conditional ones, but targeted conditions can actually strengthen credibility for certain products

- Implementation challenges: Common issues include unclear claim processes, hidden restrictions, and inconsistent internal application. Addressing these enhances both effectiveness and efficiency

For example, Zappos revolutionized online shoe retail with their 365-day return policy, addressing the fundamental uncertainty of buying shoes without trying them on—resulting in higher conversion rates and, counterintuitively, lower return rates than industry averages.

Free Trial Models: Experience Before Commitment

Free trials offer a particularly powerful approach for subscription services and complex products:

- Zero-risk exploration: Free trials completely eliminate the risk of initial purchase by allowing customers to experience value before payment

- Trial-to-paid optimization: Effective trials should demonstrate core value quickly, provide guided onboarding, and create low-friction conversion paths

- Psychological ownership: During trials, customers develop a sense of ownership that increases conversion probability. This effect strengthens the longer the trial period (within reason)

- Friction reduction: The transition from trial to paid should be as seamless as possible, with clear communication about what happens at the end of the trial

Software company Slack exemplifies this approach, offering a free tier that allows teams to experience the product’s core value indefinitely, with paid features that become relevant as usage increases—creating a natural upgrade path with minimal risk perception.

Performance and Results Guarantees

These outcome-focused guarantees are particularly effective for services and performance-oriented products:

- Outcome commitment: By guaranteeing specific results (rather than just satisfaction), businesses can address the fundamental risk of “Will this actually work for me?”

- Measurement frameworks: Effective performance guarantees require clear, objective ways to measure success, ideally using metrics the customer already values

- Expectation management: Setting realistic, achievable performance standards is crucial for sustainable performance guarantee programs

- Implementation considerations: These guarantees require careful legal review and operational integration to ensure the business can consistently deliver on promises

Digital marketing agency Directive Consulting offers a “Leads or You Don’t Pay” guarantee for B2B clients, directly addressing the primary risk of marketing services—that they won’t generate actual business results. This approach has helped them achieve client acquisition rates 2-3 times industry averages.

Extended Warranty and Protection Plans

These long-term guarantees address ongoing performance and durability concerns:

- Long-term risk elimination: Extended warranties address the “what if it breaks later” concern that often creates purchase hesitation for durable goods

- Premium pricing models: These programs can create additional revenue streams while addressing risk perception, creating dual business benefits

- Value perception: While the actuarial value of warranties often favors the seller, their psychological value to risk-averse customers creates genuine utility

- Segmentation opportunities: Offering tiered protection plans allows businesses to address varying risk sensitivity across customer segments

Apple’s AppleCare programs demonstrate this approach’s power, with attachment rates over 30% despite premium pricing. The program addresses specific anxiety points (screen damage, battery failure) rather than generic coverage, enhancing its perceived value.

Understanding these core guarantee strategies is essential, but their effectiveness ultimately depends on how well they’re designed and implemented. Let’s explore the principles that transform average guarantees into conversion-driving powerhouses that specifically address zero-risk bias.

Designing Guarantees That Actually Work

Not all guarantees are created equal. Some dramatically boost conversions while others sit ignored in the fine print. This section reveals the design principles that make the difference between performant guarantees and window dressing.

Core Components of Persuasive Guarantees

The most effective guarantees share several key characteristics:

- Optimized commitment level: The strongest guarantees make meaningful commitments that address actual customer concerns without creating unsustainable business risk. Finding this sweet spot is essential

- Accessible conditions: Any conditions or limitations should feel reasonable and fair to customers. Overly restrictive conditions can actually increase perceived risk rather than reducing it

- Claim simplicity: The process for invoking the guarantee should be straightforward and clearly explained. Complex claim processes significantly reduce a guarantee’s psychological impact

- Communication clarity: Guarantee messaging should be prominently displayed at key decision points, not buried in terms and conditions. The language should be simple and customer-focused

Mattress company Purple exemplifies these principles with their “100-Night Risk-Free Trial” which is prominently displayed, has minimal conditions, and features a simple return process—effectively addressing the primary risk of buying a mattress online without testing it first.

Understanding Customer Psychology

Effective guarantees are designed around specific customer psychological needs:

- Trust-building language: Words like “promise,” “commitment,” and “guarantee” trigger specific trust-related psychological responses and should be used strategically

- Anxiety targeting: Identifying and explicitly addressing the specific anxieties of your customer base makes guarantees significantly more effective than generic assurances

- Segment-specific approaches: Different customer segments often have different risk concerns. Tailoring guarantees to segment-specific anxieties increases their impact

- Skepticism management: Particularly for industries with trust challenges, guarantees must be framed to overcome inherent skepticism through social proof, transparency, and consistent messaging

Fitness program P90X addresses the specific skepticism in their industry with their “90-Day Money Back Guarantee” that specifically states “if you’re not satisfied for ANY reason”—directly confronting the common concern that fitness programs will have loopholes preventing guarantee claims.

Implementation Framework

Successful guarantee programs require thoughtful implementation:

- Cross-departmental coordination: Effective guarantees require alignment between marketing, operations, customer service, and finance to ensure consistent delivery

- Financial modeling: Businesses should model the financial impact of guarantee programs, including both the cost of claims and the revenue benefit of increased conversions

- Support infrastructure: Customer service teams need clear protocols, training, and authority to fulfill guarantee claims efficiently

- Legal compliance: Guarantee language must be reviewed for legal compliance while maintaining clarity and persuasive impact

Home essentials brand Brooklinen demonstrates excellent implementation with their “365-day warranty” that’s backed by a customer service team empowered to make decisions without complex approval chains, creating a seamless guarantee experience.

While these principles apply broadly, different industries face unique challenges in implementing guarantee strategies. Let’s explore how these approaches can be adapted to specific business contexts for maximum impact.

Industry-Specific Guarantee Applications

Different business models face unique challenges and opportunities when implementing guarantee strategies. This section provides specialized guidance for e-commerce, service businesses, and B2B companies.

E-commerce Guarantee Strategies

Online retailers can leverage several approaches to overcome the inherent uncertainties of digital shopping:

- Category-specific guarantees: Different product categories have distinct risk profiles. Apparel benefits from fit guarantees, electronics from performance guarantees, and perishables from freshness guarantees

- Digital vs. physical considerations: Digital products (software, ebooks, courses) require different guarantee structures than physical goods, often focusing on usability and satisfaction rather than return logistics

- Cart abandonment targeting: Strategically placing guarantee messaging at cart abandonment trigger points can recapture wavering customers. Exit-intent popups highlighting guarantees typically reduce abandonment by 10-30%

- Post-purchase reinforcement: Reminding customers of guarantees after purchase (in confirmation emails, package inserts, etc.) reduces buyer’s remorse and return rates

Warby Parker revolutionized online eyewear sales with their Home Try-On program, addressing the fundamental uncertainty of buying glasses without trying them on—resulting in conversion rates far exceeding industry standards.

Service Business Applications

Service businesses face unique challenges due to their intangible offerings:

- Intangibility solutions: Since services can’t be examined before purchase, guarantees play an especially crucial role in reducing perceived risk

- Satisfaction definition: Service guarantees require clear definitions of what constitutes satisfaction to avoid misaligned expectations

- Experience-based metrics: Effective service guarantees often focus on specific, measurable aspects of the customer experience rather than subjective satisfaction

- Building service confidence: Tiered guarantee approaches can build progressive confidence, from initial consultation guarantees to outcome guarantees for established clients

House cleaning service Handy offers a “Happiness Guarantee” that addresses the specific concerns of letting strangers into your home: if anything is damaged they’ll repair or replace it, and if you’re unsatisfied they’ll send another cleaner—directly addressing the primary risks of their service category.

B2B Market Strategies

Business-to-business guarantees require specialized approaches due to higher stakes and complex decision processes:

- Enterprise guarantee structures: B2B guarantees must address the distinct risks of enterprise adoption, including implementation success, team adoption, and integration with existing systems

- Relationship-building approaches: Long-term contracts benefit from progressive guarantee structures that evolve as the business relationship develops

- ROI-based guarantees: B2B customers are particularly responsive to performance guarantees tied to specific business outcomes or ROI metrics

- Legal considerations: B2B guarantees require careful contract integration and often need more detailed terms than consumer guarantees

HubSpot offers B2B customers an “Implementation Guarantee” that ensures successful software deployment within specific timeframes—directly addressing a primary risk factor in enterprise software purchases.

With these industry-specific applications in mind, how do you know if your guarantee strategy is actually working? Let’s explore the measurement approaches that help optimize guarantee programs for maximum impact.

Measuring and Optimizing Your Guarantee Strategy

Implementing guarantees isn’t the end of the journey—it’s the beginning of a continuous optimization process. This section explores how to measure effectiveness, test variations, and continuously improve your guarantee strategy.

Key Performance Indicators

Several metrics help evaluate guarantee program performance:

- Conversion impact: Measure changes in conversion rates before and after implementing guarantees, or between customer segments exposed to different guarantee messaging

- Lifetime value effects: Track how guarantees influence not just initial conversion but long-term customer value through repeat purchases and referrals

- Cost-benefit analysis: Calculate the full financial impact by comparing increased revenue against the costs of fulfilling guarantee claims

- Utilization metrics: Monitor guarantee claim rates, reasons, and patterns to identify potential product issues and refine guarantee terms

The most successful businesses track these metrics by customer segment and product category, revealing opportunities for targeted guarantee refinements.

Testing Methodologies

Systematic testing approaches reveal what actually works:

- A/B testing frameworks: Test different guarantee structures, language, and placement to identify the most effective approaches. Even small wording changes can significantly impact effectiveness

- Multivariate testing: More advanced testing can reveal how guarantee elements interact with other page elements, price points, and customer segments

- Feedback collection: Direct customer feedback about guarantee perceptions provides qualitative insights that complement quantitative data

- Longitudinal studies: Track the long-term impact of guarantees on customer satisfaction, loyalty, and word-of-mouth referrals

These testing approaches should be ongoing rather than one-time events, as customer expectations and competitive landscapes continuously evolve.

Continuous Improvement Process

Establish a systematic approach to guarantee optimization:

- Performance-based refinement: Use data from both tests and actual guarantee usage to continuously refine your approach

- Behavioral analysis: Study customer interaction with guarantee messaging through heat maps, scroll depth, and engagement metrics

- Competitive benchmarking: Regularly assess competitors’ guarantee strategies to identify opportunities for differentiation

- Adaptation planning: Create processes for updating guarantees in response to changing market conditions, product evolutions, and customer expectations

Companies with the most effective guarantee programs typically review and refine them quarterly, treating them as dynamic marketing assets rather than static policies.

While theoretical knowledge is valuable, nothing beats seeing real-world examples of successful implementation. Let’s examine case studies of businesses that have transformed their results through strategic guarantee approaches.

Success Stories: Guarantees in Action

Learning from real-world examples helps turn theory into practical application. This section showcases businesses that have successfully implemented guarantee strategies to overcome zero-risk bias and drive growth.

E-commerce Success Stories

Online retailers have found creative ways to address the unique uncertainties of digital shopping:

- Amazon’s Approach: Amazon’s seamless return process and “A-to-Z Guarantee” for marketplace purchases helped overcome early consumer hesitation about online shopping. This customer-centric guarantee approach contributed significantly to their early growth advantage

- Direct-to-Consumer Innovations: Mattress company Casper revolutionized their category with a 100-night trial that eliminated the primary risk of buying a mattress online. This approach increased their conversion rates by over 60% compared to industry standards

- Conversion Improvements: Clothing retailer ASOS implemented a free return policy prominently featured throughout the purchase journey, resulting in a 32% increase in conversion rates and, counterintuitively, a decrease in return rates

- Implementation Lessons: Outdoor retailer REI’s lifetime satisfaction guarantee required operational adjustments when abuse increased, demonstrating the importance of sustainable guarantee design. Their refined approach maintains customer confidence while ensuring business viability

These examples demonstrate how guarantees can transform e-commerce performance when designed around specific customer anxieties rather than generic assurances.

Service Business Transformations

Service companies have leveraged guarantees to overcome the inherent intangibility of their offerings:

- Marketing Service Innovations: Digital agency Single Grain offers performance-based guarantees for specific metrics like lead generation and conversion rates, resulting in client acquisition rates 40% higher than competitors with traditional hourly billing models

- Professional Service Approaches: Accounting firm Baker Tilly implemented a satisfaction guarantee for tax preparation services, increasing new client acquisition by 28% in a traditionally risk-averse service category

- Subscription Retention Impact: Meal kit service HelloFresh guarantees ingredient freshness with credits for any quality issues, contributing to retention rates 15% higher than competitors without similar guarantees

- ROI Measurement: Home services platform Thumbtack’s “Happiness Guarantee” costs approximately 3% of revenue to maintain but contributes to conversion improvements worth an estimated 22% of revenue—a significant positive ROI

Service businesses often see particularly dramatic results from guarantee strategies because they address the fundamental “leap of faith” required when purchasing intangible offerings.

Innovative Guarantee Models

Some businesses have created entirely new approaches to guarantees:

- Livestream Commerce: Platforms like TaoBao Live have implemented real-time guarantee displays during streaming events, increasing conversion rates by up to 70% compared to identical offerings without visible guarantees

- Digital Product Approaches: Course provider Masterclass offers a 30-day satisfaction guarantee prominently featured in their marketing, contributing to conversion rates approximately 35% higher than industry averages

- Sustainability Guarantees: Outdoor brand Patagonia’s “Ironclad Guarantee” includes repair and recycling options that align with their environmental values while building customer confidence

- Technology-Enabled Models: Smart luggage company Away uses their connected products to automatically trigger warranty processes when problems are detected, creating a seamless customer experience that builds loyalty

These innovative approaches demonstrate that guarantees continue to evolve beyond traditional models, creating new opportunities for businesses to address zero-risk bias.

While guarantees offer powerful benefits, they also come with important responsibilities. Let’s explore the ethical considerations and potential challenges of implementing guarantee strategies.

Ethical Considerations and Potential Challenges

Implementing guarantee strategies involves important ethical considerations and practical challenges. This section explores how to create responsible, sustainable approaches that build authentic trust.

Balancing Promise and Delivery

Ethical guarantee strategies require careful alignment between what’s promised and what’s delivered:

- Setting realistic expectations: Guarantees should make meaningful commitments without creating unrealistic expectations that lead to inevitable disappointment

- Avoiding misleading claims: Guarantee language should be truthful and clear, without hidden conditions that undermine the promise being made

- Ensuring fulfillment capability: Businesses must have the operational infrastructure and financial resources to honor guarantees consistently

- Ethical frameworks: Develop internal guidelines that balance marketing impact with authentic customer care when designing guarantees

The most successful guarantees create genuine value for both customers and businesses by addressing real risks without resorting to misleading tactics or unsustainable promises.

Risks and Implementation Challenges

Several common challenges require careful management:

- Financial implications: Guarantees create financial obligations that must be properly modeled and accounted for, including both direct costs and operational overhead

- Reputation considerations: Poorly implemented guarantees that create customer friction during claims can damage brand reputation more than having no guarantee at all

- Abuse prevention: Businesses need balanced approaches to prevent guarantee abuse without creating an adversarial relationship with legitimate customers

- Scalability planning: As businesses grow, guarantee programs must scale accordingly with appropriate systems, staffing, and processes

These challenges explain why guarantee programs require cross-functional collaboration rather than being treated as simply marketing initiatives.

Regulatory and Legal Compliance

Guarantees operate within important legal frameworks:

- Industry-specific regulations: Certain industries (financial services, healthcare, etc.) have specific requirements governing guarantee language and implementation

- International considerations: Businesses operating across borders must adapt guarantee programs to comply with local requirements, which vary significantly

- Disclosure requirements: Many jurisdictions have specific rules about how guarantee terms must be disclosed and what constitutes deceptive practices

- Dispute resolution: Clear, fair processes for resolving disagreements about guarantee claims are both legally prudent and customer-friendly

Legal compliance and ethical implementation are not opposing considerations but complementary aspects of effective guarantee strategies.

As technology and consumer expectations continue to evolve, guarantee strategies are also transforming. Let’s explore emerging trends and innovations that will shape the future of addressing zero-risk bias.

Future Trends in Guarantee Strategies

The landscape of guarantee strategies continues to evolve with new technologies and changing consumer expectations. This section explores emerging trends that forward-thinking businesses should monitor.

Technology-Enabled Guarantee Innovations

New technologies are creating novel guarantee possibilities:

- Blockchain verification: Distributed ledger technologies are enabling transparent, tamper-proof guarantee records that enhance credibility for high-value purchases

- AI-driven personalization: Machine learning algorithms can customize guarantee offerings based on individual customer risk profiles and past behaviors

- IoT integration: Connected products are enabling proactive guarantees that identify and address problems before customers even notice them

- Digital verification systems: New authentication technologies are simplifying proof-of-purchase requirements for guarantee claims, reducing friction in the claim process

These technologies help businesses offer stronger guarantees while managing costs through increased efficiency and reduced fraud.

Evolving Consumer Expectations

Customer expectations around guarantees are changing rapidly:

- Next-generation standards: What was once considered an exceptional guarantee increasingly becomes the minimum expectation, requiring continuous innovation

- Trust signal integration: Consumers increasingly look for multiple trust indicators working together, with guarantees as one element in a broader trust ecosystem

- Social proof interaction: The relationship between guarantees and social validation is strengthening, with guarantees gaining credibility through community endorsement

- Generational shifts: Younger consumers show distinct preferences for guarantee structures, with Gen Z particularly valuing transparency and authenticity in guarantee messaging

These evolving expectations require businesses to regularly reassess their guarantee strategies rather than treating them as static policies.

Strategic Integration Opportunities

Forward-thinking businesses are finding new ways to integrate guarantees into broader strategies:

- Loyalty program connections: Innovative companies are creating tiered guarantee benefits that reward customer loyalty while encouraging repeat purchases

- Cross-business partnerships: Collaborative guarantees across complementary businesses are creating stronger overall value propositions

- Community-based models: Some businesses are experimenting with community-validated guarantee claims that leverage customer communities as part of the verification process

- Impact guarantees: Sustainability and social impact guarantees are emerging as powerful differentiators in values-conscious market segments

These integrations represent the next frontier in guarantee strategy, moving beyond standalone policies to interconnected systems that create comprehensive trust and value.

With all these insights in mind, let’s conclude with a practical implementation framework that you can apply to your specific business context.

Implementing Your Zero-Risk Strategy: A Practical Framework

Let’s translate everything we’ve explored into a practical framework you can apply to your business. This actionable approach will help you implement effective guarantee strategies that address zero-risk bias and drive measurable results.

Step 1: Assessment and Strategy Development

Begin by understanding your specific opportunities:

- Risk audit: Identify the specific risks and uncertainties customers perceive in your purchase process through surveys, customer service data, and exit interviews

- Competitor analysis: Evaluate competitors’ guarantee approaches, identifying opportunities for meaningful differentiation

- Customer segmentation: Determine how risk perception varies across your customer segments to develop targeted approaches

- Business impact modeling: Create financial projections for different guarantee approaches, including both implementation costs and revenue benefits

This foundation ensures your guarantee strategy addresses actual customer concerns rather than assumed risks.

Step 2: Design and Development

Create your guarantee program with these key elements:

- Guarantee structure: Select the appropriate type (money-back, free trial, performance, etc.) based on your specific business and customer needs

- Terms and conditions: Develop clear, fair terms that balance customer confidence with business protection

- Claim process: Design a simple, transparent process for customers to invoke the guarantee when needed

- Communication strategy: Create messaging that effectively communicates your guarantee at key decision points in the customer journey

The most effective guarantees are designed holistically rather than treating these elements as separate considerations.

Step 3: Implementation and Operations

Put your guarantee into action with these operational considerations:

- Team training: Ensure all customer-facing staff understand the guarantee and are empowered to fulfill it consistently

- System integration: Update relevant systems (CRM, e-commerce, etc.) to track and process guarantee claims efficiently

- Rollout planning: Consider whether to launch your guarantee program all at once or in phases to manage risk and gather learning

- Feedback mechanisms: Establish systems to collect both customer and employee feedback about the guarantee program

Operational excellence in guarantee fulfillment is as important as the guarantee design itself for building genuine trust.

Step 4: Measurement and Optimization

Create a continuous improvement cycle:

- KPI tracking: Monitor key metrics including conversion impact, claim rates, customer satisfaction, and financial performance

- A/B testing program: Systematically test variations in guarantee structure, language, and presentation to optimize effectiveness

- Regular review cycles: Establish quarterly review processes to assess performance and identify improvement opportunities

- Competitive monitoring: Continuously track changes in competitor guarantees and evolving industry standards

This systematic approach ensures your guarantee strategy remains effective as market conditions and customer expectations evolve.

Conclusion: Turning Risk Into Opportunity

Zero-risk bias represents both a challenge and an opportunity for businesses. By understanding this fundamental aspect of customer psychology, you can transform perceived risks from conversion barriers into powerful trust-building assets.

Effective guarantee strategies do more than just address risk—they signal confidence in your offerings, differentiate your brand, and create meaningful competitive advantages. When thoughtfully designed and consistently implemented, they create a virtuous cycle of increased customer confidence, higher conversion rates, and stronger customer relationships.

The most successful approaches share several characteristics:

- They address specific customer anxieties rather than generic risks

- They’re communicated clearly and prominently throughout the customer journey

- They’re designed holistically with both marketing impact and operational feasibility in mind

- They’re continuously measured and refined based on performance data

As you implement your own guarantee strategy, remember that authenticity is paramount. The strongest guarantees are those backed by genuine confidence in your offerings and a sincere commitment to customer satisfaction. This authentic foundation, combined with the strategic approaches we’ve explored, creates guarantees that don’t just drive initial conversions but build lasting trust and loyalty.

By transforming how customers perceive risk in doing business with you, effective guarantee strategies don’t just address zero-risk bias—they turn it from a conversion obstacle into a powerful business advantage.

Looking to implement these guarantee strategies in your Shopify store? The Growth Suite application helps merchants design, test, and optimize effective guarantees that address zero-risk bias and boost conversions—transforming hesitant browsers into confident buyers with strategic risk-reduction messaging throughout the customer journey.

References

- Semantic Scholar. (2017). Measuring the Zero-Risk Bias: Methodological Artefact or Decision-Making Strategy?

- Adcock Solutions. (2004). No.36 Zero Risk Bias & Shopping Sustainably.

- LinkedIn. (2025). Importance of a risk reversal guarantee for inbound marketing services.

- LinkedIn. (2023). HOW TO REVERSE THE RISK TO GUARANTEE SALES.

- Semantic Scholar. (2024). Effect of service guarantee on consumer purchase intention in livestream marketing.

- Semantic Scholar. (n.d.). Psychological Perspectives on Perceived Safety: Zero-Risk Bias, Feelings and Learned Carelessness.

- Semantic Scholar. (2023). Robust time-consistent strategy for the defined contribution pension plan with a minimum guarantee under ambiguity.

- NCBI. (2024). Cost-effectiveness uncertainty may bias the decision of coal power transitions in China.

- arXiv. (2023). Towards a unified approach to formal risk of bias assessments for causal and descriptive inference.

- Semantic Scholar. (2024). A Blockchain-centered Strategy for Ensuring Secure Data Sharing with Management Keys in IoT Environments.

- LinkedIn. (2023). Heuristic of the Day: Zero-Risk Bias.