Have you ever wondered why you sometimes feel excited when a price seems low, or why a certain deal makes your heart race? Could it be that your brain is doing more than just simple math when evaluating cost? By the time you finish reading this article, you’ll understand exactly how your brain processes prices on both a rational and emotional level. We’ll dive into key brain areas, uncover fascinating research methods, and explore how all this can shape real-world strategies in marketing and beyond. Ready to discover the secrets of price processing? Let’s begin!

Introduction to Price Processing in the Brain

What to expect in this section: You’ll learn how neuroscience, psychology, and economics combine to form a new way of understanding how we react to prices. We’ll also explore the historical background of price processing research and highlight the key brain structures involved.

The Neuroscientific Approach to Economic Decision-Making

Neuroeconomics is the science that brings together economics, psychology, and neuroscience to study how we make decisions involving cost, risk, and reward (Chen, 2022). Historically, researchers tried to understand pricing by analyzing only behavior or pure economics. However, by looking at the brain itself, we can see which areas light up when people encounter certain price tags. Key structures include the prefrontal cortex for higher thinking and the striatum for reward anticipation. These discoveries help explain why our decisions aren’t always purely logical.

We’ve seen how neuroeconomics shaped the study of price. Ready to look at the brain’s overall cost-benefit system? Keep reading!

The Economic Brain: Conceptual Framework

The human brain acts like a cost-benefit calculator, juggling thoughts and emotions when we see a price tag. Sometimes we rely on rational thinking (“Is this price truly fair?”), and other times we’re driven by emotional impulses (“This feels exciting!”). Interestingly, many of our price evaluations happen unconsciously, rooted in our evolutionary need to manage resources wisely. Our ancestors weighed immediate survival costs, much like we now assess if that new gadget is worth the money. This blend of conscious and unconscious processes shows just how deep our price perceptions run.

Next, we’ll explore why understanding this framework matters. From clinical fields to the marketplace, price research has surprisingly widespread applications.

Significance and Applications

Studying how the brain processes prices can help in clinical settings, especially for disorders related to valuation or impulsive buying. On the commercial side, marketers use these insights to design strategies that resonate with our reward systems. Of course, there are ethical questions: Should we use brain data to influence consumer behavior? This article will cover these concerns and highlight the main themes so you can see how everything ties together.

We’ve set the stage for understanding the basics. Let’s dive into the scientific techniques behind these discoveries!

Neuroscientific Methods for Studying Price Processing

What to expect in this section: We’ll look at the tools researchers use, such as fMRI and EEG, to uncover the hidden layers of price processing. We’ll also explore how these methods are applied in commercial settings.

Functional Magnetic Resonance Imaging (fMRI)

fMRI tracks blood flow changes in the brain to see which regions activate when we judge a price. It’s quite precise, allowing us to pinpoint areas involved in valuation and reward (Basten et al., 2010). However, cost is a big factor, with research facilities charging around $696 per hour (Yale Magnetic Resonance Research Center, 2024). This expense means only specific studies or well-funded commercial projects can afford it. Despite the price tag, fMRI remains a gold standard for detailed brain imaging in price processing research.

But what if we need a simpler or more portable option? Let’s see how EEG fits into the picture.

Electroencephalography (EEG) and Event-Related Potentials

EEG measures the brain’s electrical activity. Researchers can track N400 responses, which indicate whether a price feels “off” or unexpected. EEG is also excellent for studying time-course changes, because it captures brain activity in milliseconds. Neural oscillations, such as alpha and gamma waves, offer hints about how we process information related to cost. EEG’s affordability and accessibility make it popular in both academic and market research (Neurons Inc., 2023).

Of course, EEG can’t show us the exact brain location in fine detail. That’s where other tools come into play.

Other Neuroimaging and Physiological Techniques

Eye-tracking helps researchers understand where people focus their gaze, revealing which parts of a price capture the most attention. Skin conductance measures emotional arousal, while facial electromyography detects tiny muscle changes that reflect positive or negative reactions. When combined, these methods offer a 360-degree view of how people respond to different price points, both cognitively and emotionally (Future Proof Insights, 2023).

Now, let’s see how these methods transition from the lab to industry.

Neuro Price Testing in Commercial Applications

Companies leverage brain-based methods—like EEG headsets or fMRI scans—to measure consumer reactions to prices before launching a product. This practice, known as Neuro Price Testing, helps them refine price points and predict market success. Academic studies provide a foundation, but businesses perform validation tests to confirm these findings in real-world contexts (Future Proof Insights, 2023). Ethical questions arise when consumer autonomy might be compromised, so transparency is key.

Next, let’s dive into the specific brain regions at play. Get ready to meet the brain’s “price headquarters.”

Neural Architecture of Price Processing

What to expect in this section: We’ll tour the main brain regions—like the prefrontal cortex and reward circuits—to see how they work together when we evaluate cost. You’ll discover how emotions factor in and why our brain’s response is a team effort.

Prefrontal Cortex in Value Computation

The ventromedial prefrontal cortex (vmPFC) integrates emotional signals, helping you decide if the benefits of a product outweigh its cost. Meanwhile, the dorsolateral prefrontal cortex (dlPFC) adds logical thinking by weighing different factors, like quality and personal budget (Xie et al., 2016). Interestingly, the left side of the frontal lobe can be linked with approach behaviors (impulses to buy), while the right side often relates to avoidance (impulses to hesitate). Over time, as our brains mature, these areas refine their coordination, affecting how we judge prices throughout life.

Now that we’ve seen the command center, let’s peek into the brain’s “reward engine.”

Reward Circuitry and Price Evaluation

Ever felt a small jolt of excitement when you spot a big discount? That might be your ventral striatum or nucleus accumbens lighting up. These regions handle reward anticipation and are fueled by dopamine, a chemical messenger tied to pleasure. Research shows our willingness to pay often rises when these reward circuits are active. Essentially, we weigh the product’s value and the cost in these circuits to determine if it’s worth the purchase (Karmarkar et al., 2014).

But pricing is not just about reward; emotions play a huge role too. Let’s check that out next.

Emotional Processing of Price Information

The amygdala comes alive when we see extreme prices—either very high or surprisingly low—alerting us to potential threats or rare opportunities. Meanwhile, the insula reacts to perceptions of fairness and unfairness. If a price feels exploitative, the insula’s activity could spike, signaling a negative emotional response. The anterior cingulate cortex (ACC) steps in to resolve conflicts: “Should I pay this high price for something I love, or walk away?” Our emotions merge with logical thoughts, resulting in a final purchase decision (Tremblay, 2018).

It’s fascinating how every region plays a unique part. Now, let’s see how they collaborate across the brain.

The Distributed Neural Network of Price Processing

Price evaluation isn’t limited to one “price center.” It’s a network process involving the prefrontal cortex, reward circuits, and emotional centers. Individual differences—like income or spending habits—also modify how these regions connect. For some, a high price triggers reward signals (due to perceived quality), while others interpret it as a threat. Over time, these neural interactions evolve, reflecting changes in personal values and life experiences.

Feeling enlightened about the brain’s structure? Let’s move to the thought processes behind each price decision.

Cognitive Processes in Price Evaluation

What to expect in this section: We’ll look at how your brain pays attention to prices, stores them in memory, calculates effort costs, and processes them over time. This cognitive angle adds more depth to the neural picture.

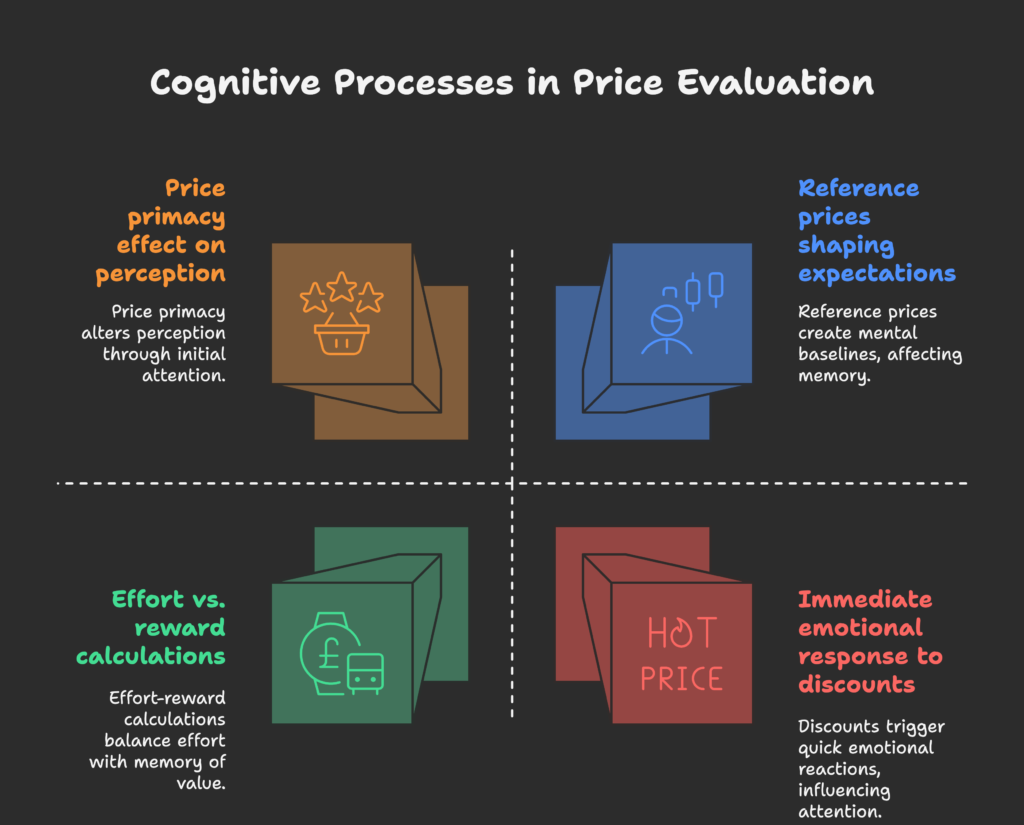

Attention and Price Primacy Effects

Have you noticed how seeing the price before the product can shift your entire perception? Researchers find that price primacy can lead us to judge the product more strictly based on cost. On a neural level, brain areas linked to visual attention and reward respond differently when the price appears first (Merchant et al., 2013). This means you might adore a product less if you think the price is too high from the start. The practical lesson? Retailers know how to place price tags to guide consumer focus.

Now, let’s see how your memory shapes price expectations.

Memory Systems in Price Processing

Over time, your brain forms “reference prices,” which act like mental baselines for what something should cost. The hippocampus helps store these price memories, and when you encounter a new price, you compare it to your internal reference. If there’s a mismatch, prediction errors arise, nudging you to adjust your expectations. Long-term memory locks in typical price points for items you buy often, while working memory handles short-term comparisons, like scanning multiple prices in a store.

But price evaluation isn’t just about memory—it also involves balancing effort and reward. Let’s delve into that.

Effort-Based Cost-Benefit Calculations

When we factor in the effort of obtaining or using a product, regions like the ventral striatum and midbrain come into play once again (Botvinick et al., 2009). For instance, “Is it worth driving across town for a cheaper option?” Our brain calculates the mental and physical effort and balances it against the potential savings or reward. People differ in how they weigh effort: some are “bargain hunters” who love the chase, while others prefer convenience, even at a higher cost.

Finally, how does time factor into these decisions? Let’s find out.

Temporal Dynamics of Price Processing

Our response to price changes over time. Immediately, we might get an emotional jolt from a flashy discount. Later, more logical processes emerge as we weigh other factors (“Wait, do I really need this?”). This temporal integration can also influence temporal discounting, where people prefer smaller, immediate rewards over larger, delayed ones. In pricing, an immediate discount might feel more rewarding than a future promotion.

We’ve covered how cognition shapes price perception. Next, let’s explore some major research findings that unite these ideas.

Key Research Findings on Neural Price Processing

What to expect in this section: We’ll look at the major breakthroughs in how the brain brings cost and benefit together, how context shapes our price judgments, and what predicts our buying choices.

Cost-Benefit Integration in the Brain

The brain effectively sums up potential gains and losses to decide if a purchase is worth it. Dopamine is crucial here, signaling the expected value of a product (Basten et al., 2010). Interestingly, some people show stronger dopaminergic responses, making them more sensitive to discounts or loyalty rewards. This explains why certain shoppers are extremely reactive to sales while others remain indifferent.

Now, let’s see how context can shift your perception of the same price.

Price Anchoring and Context Effects

Anchoring happens when an initial price point (or reference) influences how we see subsequent prices. If you first see a $100 shirt, a $70 shirt feels like a bargain. The brain adapts to these anchors, recalibrating its sensitivity to new price ranges. Context also matters—seeing luxury goods can make mid-range items look more affordable. Savvy marketers often use anchoring to sway buying decisions.

Next up, we’ll learn how the brain sometimes predicts whether you’ll buy something before you even realize it.

Neural Predictors of Purchasing Decisions

Studies show that pre-decision brain activity, particularly in reward areas, can forecast buying choices (Karmarkar et al., 2014). In some experiments, participants’ neural responses to prices correlated with how likely they were to purchase later. However, it’s not always 100% accurate—factors like mood, memory, and external influences add complexity. Still, this line of research highlights the power of neural signals in predicting behavior.

But we’re not all wired the same way. Let’s see why.

Individual Differences in Price Sensitivity

Some of us are more price-sensitive due to income, education, or personality traits. These differences show up in brain activity, particularly in areas linked to risk and reward. Clinically, individuals with valuation disorders might exhibit abnormal responses to high or low prices, possibly leading to overspending or underspending (Botvinick et al., 2009).

We’ve now covered some pivotal findings. Ready to explore special topics like luxury goods and discount pricing? Keep going!

Special Topics in the Neuroscience of Pricing

What to expect in this section: Learn how luxury goods, promotions, price fairness, and even the “pain of paying” each have unique neural signatures.

Luxury versus Necessity Goods

Luxury goods trigger areas in the brain linked to status signaling. People often associate high price with high quality, engaging reward circuits and social judgment areas. Necessity goods, on the other hand, activate practical and survival-based valuation processes. Cultural norms also play a role: in some societies, displaying luxury might be more rewarding for social standing.

Speaking of deals, how does your brain react to discounts? Let’s find out.

Discounts and Promotional Pricing

When we see a promotion, the dopaminergic system can light up, creating a sense of excitement. Surprising discounts can amplify this response because our brain loves the feeling of “found savings.” Time-limited offers also tap into our fear of missing out, leading to quicker decision-making (Kamiya et al., 2023). The framing of the discount can further shape how the brain perceives its value.

But promotions aren’t just about feeling good. Let’s look at how fairness comes into play.

Price Fairness and the Social Brain

A perceived unfair price can trigger the insula, the region often involved in disgust or aversion. We also use theory of mind—our ability to infer others’ intentions—to judge whether a price is fair or exploitative. Cultural background and personal experiences heavily influence what we see as fair, which is why certain prices feel acceptable in one market but outrageous in another (Tremblay, 2018).

Finally, let’s explore why sometimes paying hurts—literally!

Pricing Pain and Pleasure

The “pain of paying” theory suggests that spending money can register as a pain response in the brain, particularly in the insula. Interestingly, credit cards or digital payments may reduce this “pain” by distancing us from the actual money exchange. Delayed payment (e.g., monthly installments) can also soften the emotional impact. By understanding these nuances, businesses can create pricing strategies that feel less painful to customers.

Eager to see how all this knowledge applies in the real world? Let’s move on to practical applications!

Applied Perspectives and Commercial Applications

What to expect in this section: Discover how neuromarketing teams use this information to find the perfect price, how online stores might affect our brains differently than physical stores, and what the future holds for neural price research.

Neuromarketing and Optimal Price Point Determination

Marketers utilize EEG signals and N400 responses to see if a price matches or violates consumer expectations (Neurons Inc., 2023). They might test various price levels to see which one triggers the best combination of reward and acceptance in the brain. While such methods offer deep insights, ethical debates persist about using neuroscience to nudge consumer decisions.

Now, let’s see how the digital world changes our price perceptions.

Digital and E-commerce Price Processing

Shopping online differs from shopping in physical stores. We can compare multiple prices instantly, potentially reducing our emotional bias. On the flip side, online environments can include clever design elements—pop-ups, scarcity messages, and real-time pricing—that heighten urgency and excitement. Mobile devices add another twist, since smaller screens can emphasize or hide certain price details, altering how our brain processes the information.

But not all brains see prices the same way. Culture can shape responses, too.

Cross-cultural Perspectives on Price Processing

Across different regions, the brain’s price evaluation can diverge based on socioeconomic factors and cultural values. Some cultures prioritize social harmony over individual preference, which affects fairness judgments. Others may see high price as a direct marker of status. Understanding these nuances helps global brands tailor their pricing strategies more effectively.

Finally, let’s glimpse into future possibilities in this ever-evolving field.

Future Directions in Neural Price Research

New frontiers include blending artificial intelligence with neuroscience data to predict consumer behavior even more accurately. Wearable tech might one day monitor real-time brain signals during everyday shopping. Personalized pricing models could arise, where each individual sees different prices based on their neural profile. These advances promise exciting benefits, but also raise ethical and privacy concerns.

With that, let’s wrap everything up and consider the broader picture of neural price processing!

Conclusion: Toward an Integrated Understanding

What to expect in this section: We’ll bring together all the key insights from this article and look ahead to the future challenges and opportunities in neural price research.

Synthesis of Key Findings

Price processing in the brain is a multi-layered phenomenon. From rational cost-benefit analysis in the prefrontal cortex to emotional jolts in the amygdala, multiple systems collaborate to shape our decisions. While we have uncovered major neural pathways, our understanding remains incomplete. Practical applications range from helping marketers refine prices to assisting clinicians in treating valuation-related disorders (Karmarkar et al., 2014).

Curious about the unanswered questions? Let’s highlight those next.

Future Research Directions

Technological advances promise richer data and more accurate models. Scientists aim to integrate brain signals with AI algorithms to personalize price offers. We also need more studies that track long-term behavior, because short lab experiments can’t capture real-world habits entirely. Interdisciplinary work involving psychologists, economists, and computer scientists will shape the next wave of neuro price research.

But with great power comes great responsibility. Let’s look at the ethical side.

Ethical Implications and Societal Impact

When neural data is used to influence buying behavior, consumer autonomy and privacy come into question. Regulators may need to step in as technology evolves, ensuring that companies don’t manipulate vulnerable populations. Balancing business benefits with the rights of consumers is a challenge we’ll face more and more. Still, with the right safeguards, neuroscience can help both businesses and individuals make more informed decisions.

Thank you for joining this journey through the fascinating field of price processing. By now, you should have a solid understanding of how multiple brain systems work together every time you check a price tag.

Quick Reminder: If you run a Shopify store, consider exploring apps like Growth Suite to maximize your sales by leveraging these insights. After all, understanding how the brain evaluates cost can be a game-changer in today’s competitive marketplace!

References

- Karmarkar, U. R., Shiv, B., & Knutson, B. (2014). How Our Brain Determines if the Product is Worth the Price. Harvard Business School Working Knowledge. Retrieved from https://www.library.hbs.edu/working-knowledge/how-our-brain-determines-if-the-product-is-worth-the-price

- Basten, U., Biele, G., Heekeren, H. R., & Fiebach, C. J. (2010). How the brain integrates costs and benefits during decision making. Proceedings of the National Academy of Sciences, 107(50), 21767-21772. Retrieved from https://www.pnas.org/doi/abs/10.1073/pnas.0908104107

- Tremblay, C. H. (2018). Neuroeconomic Studies in Industrial Organization: Brand, Advertising and Price Effects on Consumer Valuation and Choice. In Handbook of Behavioral Industrial Organization. Edward Elgar Publishing. Retrieved from https://liberalarts.oregonstate.edu/…_organization-2-1-18.pdf

- Block Imaging. (2024). How Much Does an MRI Machine Cost? Retrieved from https://www.blockimaging.com/bid/92623/mri-machine-cost-and-price-guide

- Yale Magnetic Resonance Research Center. (2024). Usage Charges. Retrieved from https://medicine.yale.edu/mrrc/users/charges/

- Botvinick, M. M., Huffstetler, S., & McGuire, J. T. (2009). Effort-based cost-benefit valuation and the human brain. Journal of Neuroscience, 29(14), 4531-4541. Retrieved from https://pubmed.ncbi.nlm.nih.gov/19357278/

- Neurons Inc. (2023). Pricing the brain. Retrieved from https://www.neuronsinc.com/insights/pricing-the-brain

- Merchant, H., Harrington, D. L., & Meck, W. H. (2013). Neural Basis of the Perception and Estimation of Time. Annual Review of Neuroscience, 36, 313-336. Retrieved from http://personal.inb.unam.mx/merchant/PDFSPUBLICATIONS/Neural_Basis%20_of%20the_Perception.pdf

- Future Proof Insights. (2023). Neuro Price Testing. Retrieved from https://futureproofinsights.ie/our-services/neuro-price-testing/

- Kamiya, S., Sano, A., & Shirota, Y. (2023). A Framework to Quantify Brain’s Control Costs. Neuroscience News. Retrieved from https://neurosciencenews.com/control-cost-framework-22235/

- Chen, J. (2022). Neuroeconomics: Meaning, Overview, Areas of Study. Investopedia. Retrieved from https://www.investopedia.com/terms/n/neuroeconomics.asp

- Özbay, P. S., Chang, C., Picchioni, D., Mandelkow, H., Moehlman, T. M., Chappel-Farley, M. G., … & Duyn, J. H. (2019). Sympathetic activity contributes to the fMRI signal. Communications Biology, 2(1), 1-9. Retrieved from https://www.nature.com/articles/s42003-019-0659-0

- Croxson, P. L., Walton, M. E., O’Reilly, J. X., Behrens, T. E., & Rushworth, M. F. (2009). Effort-based cost–benefit valuation and the human brain. Journal of Neuroscience, 29(14), 4531-4541. Retrieved from https://pmc.ncbi.nlm.nih.gov/articles/PMC2954048/

- Xie, Y., Nie, C., & Yang, T. (2016). A dynamic code for economic object valuation in prefrontal cortex. Nature Communications, 7, 12554. Retrieved from https://www.nature.com/articles/ncomms12554

- Merchant, H., Harrington, D. L., & Meck, W. H. (2013). Neural Basis of the Perception and Estimation of Time. Annual Reviews of Neuroscience, 36, 313-336. Retrieved from https://www.annualreviews.org/content/journals/10.1146/annurev-neuro-062012-170349